Atpar & swisspeers: Schöne neue Token-Welt

Letzte Woche haben wir einen Refresher zur Kryptowelt präsentiert – das Buch «Ignorieren auf eigene Gefahr – die neue dezentrale Welt von Bitcoin und Blockchain". Jetzt fit auf dem Thema, setzen wir uns diese Woche mit dem «Proof of Concept» auseinander, den swisspeers mit atpar durchgeführt hat.

Privatmarktanlagen (Private Markets) sind fragmentiert und bieten nur beschränkten Zugang für Kreditnehmer und Investoren. Die Tokenisierung von Vermögenswerten auf einer Blockchain wird als eine Technologie gesehen, die heutige Einschränkungen überwindet und die privaten Märkte effizient, transparent und liquide macht. Aber wie sollen die die heutigen Marktteilnehmer Finanztransaktionen in großem Maßstab tokenisieren aus ihren bestehenden IT-Systemen heraus?

Kredite in digitale Wertpapiere umwandeln

swisspeers und atpar haben einen Proof-of-Concept (PoC) durchgeführt, mit dem Ziel, den Kunden der swisspeers-Plattform zu ermöglichen, Peer-to-Peer-KMU-Kredite mithilfe des dezentralen Depository von atpar in digitale Wertpapiere umzuwandeln. Der erfolgreiche Abschluss dieses Projekts bedeutet, dass Transaktionen auf Kreditplattformen arrangiert und mit minimalem Aufwand in digitale Wertpapiere umgewandelt werden können. Darüber hinaus ist ein Vertrieb an eine breitere Investorenbasis möglich.

Die Vorteile für Kreditnehmer und Anleger reichen von niedrigeren Emissionskosten und einer Automatisierung des Wertpapierlebenszyklus bis hin zu mehr Transparenz, effizienterer Preisermittlung und Zugang zu alternativen Vertriebskanälen.

Etablierung einer dezentralen Verwahrstelle für Kreditinformationen

Beispielsweise kann ein Schweizer Anleger entscheiden, seine Investition in ein KMU-Darlehen an einer Token-Börse eines Drittanbieters zum Verkauf anzubieten. Über die dezentrale Verwahrstelle von atpar können die Marktteilnehmer an der Börse auf weitere Informationen zugreifen z.B. zu Sicherheiten oder spezifischen Vertragsbedingungen. Dadurch wird die Preisfindung erleichtert und die Liquidität erhöht, Voraussetzungen für ein dynamisches Marktumfeld.

Offenes Design: Eine gemeinsame Marktinfrastruktur mit dezentraler Verwahrstelle ermöglicht die Tokenisierung und Registrierung von Transaktionen. Dadurch werden digitale Wertpapiere mit Kapitalmarktmerkmalen erstellt.

Liquidere Privatmarktanlagen

Insgesamt bringt die neue Infrastruktur Merkmale der grossen und liquiden Kapitalmärkte in das Segment der fragmentierten und schwer zugänglichen Privatmarktanlagen. Damit werden private Markttransaktionen für Anleger attraktiver, was zu besseren Bedingungen führt, unter denen Unternehmen Kapital beschaffen können. Diese Aspekte stimmen überein mit der Mission von swisspeers: es KMUs zu ermöglichen, Kapital unter den bestmöglichen Bedingungen zu beschaffen und den Anlegern Zugang zu interessanten Investitionsmöglichkeiten zu verschaffen.

Im folgenden der ganze Artikel dazu von Nils Bundi (erstmals publiziert auf Medium)

Private Markets 2.0

Background

With USD 5.8 trillion AUM as per 2018 private market fundraising is still small compared to the more than USD 170 trillion global capital markets. There are a number of reasons why global capital markets are favored over private markets: e.g. efficient price-discovery (1), mitigation of risks through trusted intermediaries (2), and convenient access to diverse investment opportunities (3). These capabilities are enabled by a mutualized market infrastructure operated by trusted intermediaries starting with depositaries, custodians, transfer agents, paying agents, automated exchanges and, ultimately, financial information vendors. However, the cost associated with this infrastructure restricts access to capital markets to only large corporates raising enough capital such that the associated fees are offset while still giving investors an appropriate return.

Therefore, private market originators like swisspeers offer an alternative for SMEs to satisfy their financing needs in a time and cost-efficient way. In fact, swisspeers offers a fully digital borrower and investor onboarding experience as well as an automated loan auctioning process, portfolio management tools and a secondary market for investors to trade fractions of their investments. While swisspeers specifically addresses Swiss SMEs similar platforms have emerged in the past years each targeting a specific niche market.

Generally, the challenge for this industry is to grow from niche to mass markets and attract a more diverse investor base. This is because private markets and market infrastructure is fragmented across industries, geographies and originators essentially locking information and financial transactions in the respective origination platforms. As a result, price discovery and the overall investment process across origination platforms is cumbersome and costly. Essentially, investing in and managing a diversified portfolio of financial transactions currently requires an investor to interact with each and every origination platform individually.

Distributed ledger technology offers a radically different approach to defining IT system boundaries essentially allowing well-defined information, such as the details of a private market transaction, to flow securely and seamlessly across systems. In addition, tokenization offers a very cost-effective way of digitally securitizing financial transactions and transferring these as digital securities.

Essential information about the underlying financial transaction can be attached directly to the digital security giving market participants transparency on what they are potentially buying. Furthermore, smart contracts can implement the business logic associated with the full lifecycle of financial transactions automating for instance corporate actions. Hence, if designed appropriately digital securities deployed on a distributed ledger build the mutualized infrastructure bringing capital markets benefits to private markets, yet without the need for additional intermediaries.

In the context of swisspeers this means that investors have the choice to either keep their SME loans in custody of and managed by swisspeers or to “free up” these loans as digital securities in order to leverage third-party servicers and distribution channels. As an example, think of a third-party custodian safely holding all your securities across issuers and origination platforms. Or, consider listing your digital securities on a cross originator token exchange. In fact, these new distribution channels are creating a universe of private market investment opportunities which was nonexistent previously.

Therefore, atpar offers an open Decentral Depository built on distributed ledger technology (DLT). Similar to the role of a securities depository on established capital markets this Decentral Depository acts as the registry for securities, records their term sheets and beneficiaries and supports advanced features such as the processing of corporate actions, fixing of pricing events, and distribution of dividends. Hence, the Decentral Depository takes over the services traditionally provided by intermediaries such as transfer agents, calculating agents, paying agents on traditional capital markets. Thereby, the Decentral Depository allows market participants to invest in digital securities without having to interact with the various origination platforms directly which makes managing a diversified portfolio simpler by orders of magnitude. At the same time, the origination platforms still play an important role in particular since they de facto act as the investors’ trustee and, hence, actively intermediate e.g. in times of distress.

In the next sections we will present an outline of the PoC evaluating the viability and benefits of utilizing this Decentral Depository for turning swisspeers SME loans into digital securities.

Project outline

As previously mentioned swisspeers offers a fully digital SME lending platform including automated matching (primary market) and exchange for trading of fractional loan ownership (secondary market). Furthermore, swisspeers has already implemented a digital token representing fractional loan ownership and potentially simplifying backoffice processes related to the settlement of secondary market transactions. The goal of this project was to validate the possibility of registering a swisspeers loan in tokenized form in atpar’s Decentral Depository. Therefore, key is for the Decentral Depository to accurately represent the loan terms & conditions and lifecycle logic in order to give market participants the necessary transparency for efficient price discovery as well as loan servicing capabilities.

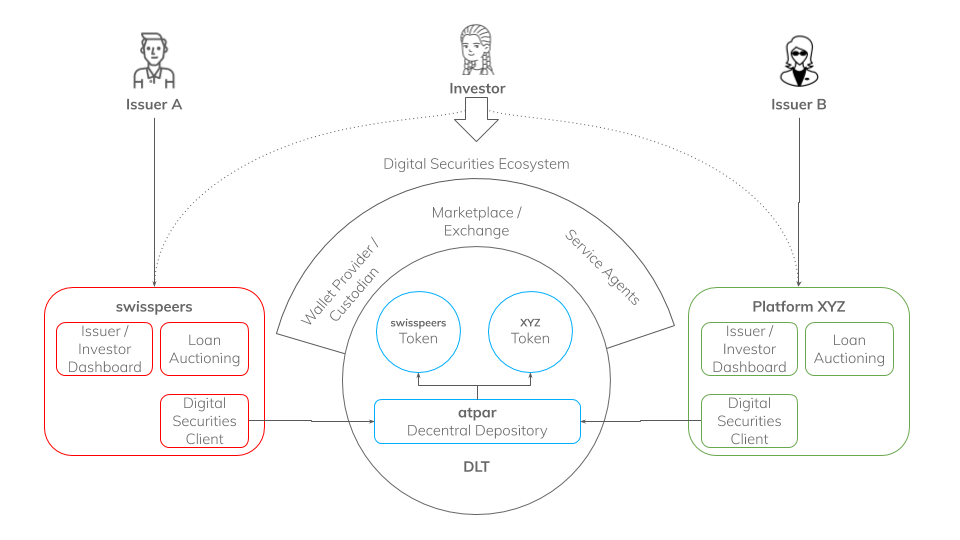

Figure 1: Current market design: Origination platforms facilitate the issuance of private market transactions in silos. Thereby, managing diversified portfolios is cumbersome.

Figure 1 depicts the current private market landscape featuring swisspeers as an SME loan originator (in red), Platform XYZ (in green) as another originator of financial transactions and banks serving as e.g. paying agents (in the middle). Issuer A, of an SME loan, accesses all information and intermediary functions through the swisspeers platform. Similarly, Issuer B, of e.g. a consumer credit, interacts exclusively with the Originator XYZ. The two platforms use different banks as paying agents through which loan amounts are paid out and interest and loan repayment is settled. For the investor looking at creating a diversified portfolio this means he has to onboard on both platforms and both banks. Obviously, this is inconvenient at least and for many investors adds too much of a burden in order to tap into these attractive markets.

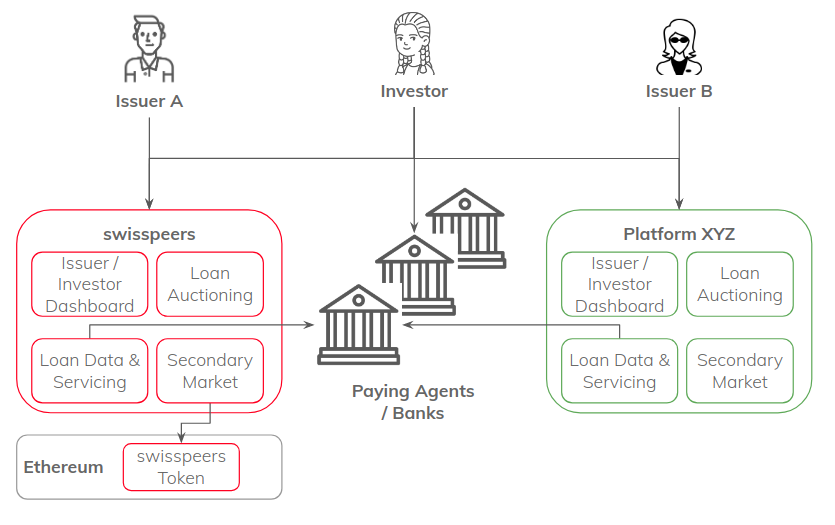

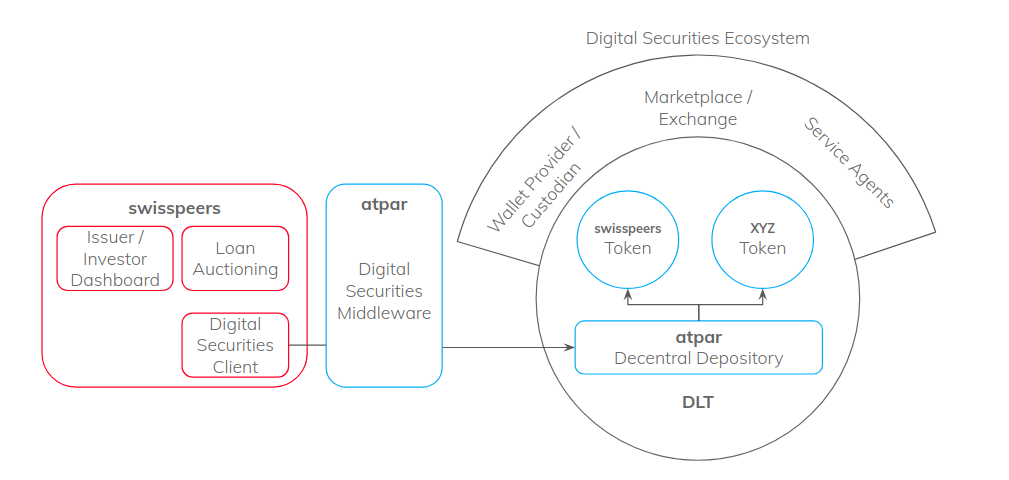

We present an alternative market architecture in figure 2. This architecture builds on the Decentral Depository which acts as a central registry for securities issued on different origination platforms such as swisspeers or Platform XYZ. As mentioned previously, the Decentral Depository provides a DLT-powered ledger for securities’ term sheets which are tokenized creating digital securities. Around the Decentral Depository a digital securities ecosystem offers additional services provided by third-party solutions. Through these, the digital securities can be managed “centrally”, i.e. from within a single wallet or through a single custody provider, listed on third-party exchanges and large parts of their lifecycle including processing of corporate actions can be automated. Finally, because the Decentral Depository is built on DLT the information on these digital securities is made available to all stakeholders and across IT system boundaries. Figure 2: Open market design: A mutualized market infrastructure — a Decentral Depository — allows for tokenization and registration of private market transactions creating digital securities with capital market features.

Figure 2: Open market design: A mutualized market infrastructure — a Decentral Depository — allows for tokenization and registration of private market transactions creating digital securities with capital market features.

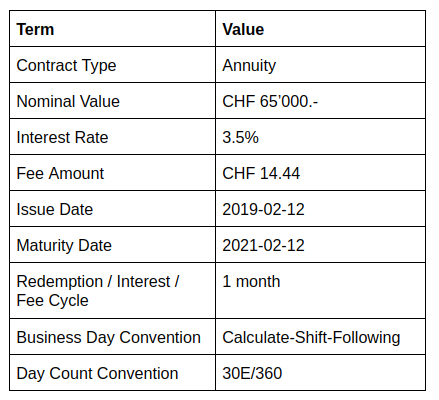

To further break things down we have identified a concrete swisspeers loan, replicated its term sheet and registered it with the Decentral Depository. The following table provides a stylized term sheet containing key terms of the respective loan.

Table 1: Excerpt of the digital term sheet of a swisspeers test transaction — a 24-months SME loan with monthly coupon and redemption.

Turning to the security’s lifecycle, the loan schedule — a well-defined sequence of contractual events derived from the term sheet — is linked to the token and dynamically updated. Figure 3 provides an excerpt of this schedule provided through the Decentral Depository. As can be seen the loan lifecycle essentially consists of three monthly payment obligations of the issuer. More specifically, after loan issuance (Initial Exchange Date, IED) every second of the month, or the next following business day, the following events are due:

a repayment of the loan amount outstanding (Principal Redemption, PR) an interest payment computed according to the current loan amount outstanding, the loan’s interest rate and day count convention (Interest Payment, IP)

a fixed fee payment (Fee Payment, FP)

Figure 3: Excerpt of the loan schedule of a swisspeers test transaction. The loan schedule is derived from the loan term sheet (see Table 1) through the Decentral Depository.

In capital market transactions the complexity of calculating such numbers correctly and the trust in that the numbers comply with the term sheet is delegated to specialized intermediaries or the Calculating Agent, respectively. Here, the Decentral Depository consisting of a set of open, transparent and auditable smart contracts takes over this role thereby making third party intermediaries optional.

The PoC has shown that the Decentral Depository is capable of accurately representing the swisspeers SME loan term sheet. Furthermore, the calculating agent service computes a correct loan schedule which is 100% consistent with the swisspeers calculations.

Benefits for SMEs and investors

The technological setup explored in this PoC provides a number of benefits for private market participants and, in particular, SMEs and investors. Essentially, by packaging loans in a standardized way across products and origination platforms (1), digitizing term sheets and lifecycle business logic (2), and moving this information to the Decentral Depository (3) these products are “freed-up” from currently siloed systems bringing capital markets features to a fragmented market.

In particular, a number of benefits for market participants are highlighted here:

Issuers

- Access to a broader investor base

- Better financing conditions due to more attractive offerings

- Individualized financing options due to flexible product configurations

Investors

- Access to alternative investment opportunities across origination platforms

- Take control of digital securities: make intermediaries optional take advantage of new services such as listing on third party exchange

- Simplified price discovery due to standardized, digital term sheets

Origination platforms

- Scale business by growing investor base

- Faster go-to-market with new products through flexible product configuration

- Reduce cost through fully digital and automated capital markets infrastructure (Decentral Depository with Transfer Agent, Calculating Agent, and Paying Agent functionality)

Hence, ultimately, the benefits presented above make private market transactions more attractive to a broader class of investors bringing liquidity to origination platforms and borrowers.

Conclusion and outlook

The goal of this project was to validate that the SME loans originated on the swisspeers platform can be registered with and accurately represented through the Decentral Depository. Therewith, private market transactions like peer-to-peer SME loans can be “freed up” from existing siloed systems and enriched with capital markets characteristics on a mutualized, financial infrastructure built on public ledgers.

Through a real-world test transaction — a 2-year, CHF 65’000.- SME loan with monthly amortization and interest payments — we were able to show that such instruments can be fully digitized and registered with the Decentral Depository. Thereby, the loans are made available as alternative investment opportunities to a broader investor base “outside” the swisspeers platform essentially transforming them into digital securities. These digital securities embed a loan term sheet as well as business logic allowing for efficient price discovery and automation of large parts of their lifecycle.

This makes swisspeers loans more attractive to investors bringing liquidity and cost-savings to the parties involved ultimately allowing SMEs to raise at favorable terms.

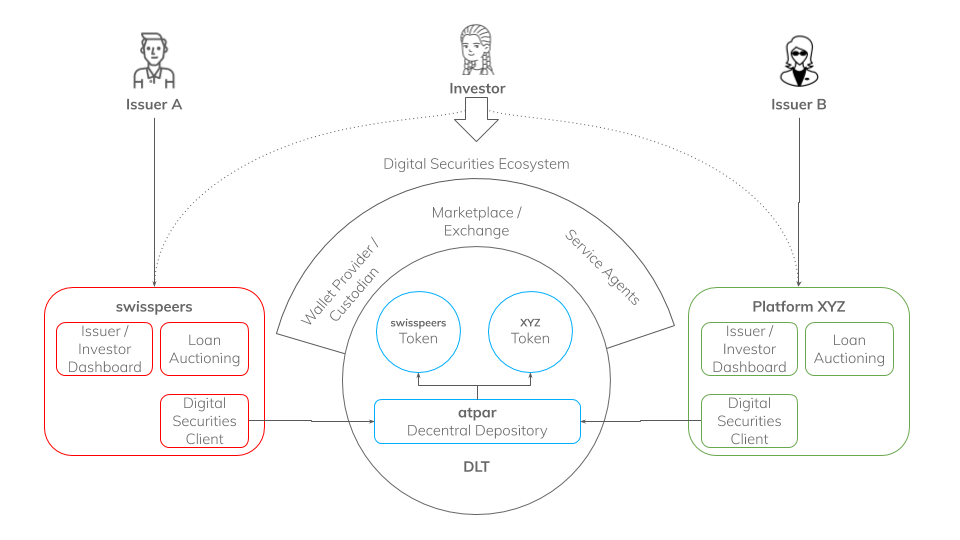

Figure 4: Scope of the next project phase — seamless integration of the Decentral Depository through the atpar Digital Securities Middleware.

After successfully concluding this PoC swisspeers and atpar will now enter a next project phase with the goal to connect the swisspeers platform with the Decentral Depository in a seamless way (1) and explore listing of a swisspeers digital security on a token exchange (2).

In order to achieve the first goal, we will use the atpar Digital Securities Middleware as an integration layer taking care of the intricacies of building upon smart contracts running on a public ledger using blockchain technology. For the second goal, we are currently exploring a possible collaboration with an emerging security token exchange in Europe.

Are you interested in this project and want to learn more about swisspeers or atpar? Get in touch or just follow us: Email (contact@atpar.io), Web, Twitter.